Listen to our Podcasts

In this article, you learn every single detail about the biggest financial

crisis of India fired from an economic slowdown and how it can affect India

for years. And..

- The fight between the Indian States and

the Central government

- How BJP-ruled states joined the protests

along with opposition against the Center

- How crisis delayed health infrastructure

development before the second Covid-19 wave

In 2017, the central government introduced the brand-new taxation policy, Goods and Services Tax or GST. In which, the government proposed three types of it. Central GST collected by the union government, State GST collected by states, and Integrated GST. When the central government introduced it, many states and economists opposed its implementation. The first reason asserted - the states would no longer possess taxation rights after most taxes were placed under GST. Second, revenues would fall because GST is imposed on those who consume goods and services in whatever state no matter in what state it is produced. To simplify, it was a destination-based tax that replaced the origin-based tax. This was deeply problematic because states made massive investments on roads, highways, and ports to incentivize manufacturing. And in GST, in whichever state the population is good enough, it would collect more GST as compared to lower population states. Economists warned of the implementation would raise the revenue uncertainty for states and needs major changes.

The Central government then assured states on the recommendation of the newly formed GST Council after some legal proceedings by making a law, The GST Compensation to States Act 2017, that it would provide compensation for how much states lost in revenues for five years from until June 2022. The center gave away a guarantee in the hope that GST would be successful and both, states and the Center would fulfill their revenue targets. Even it said that the Center would provide compounded 14% compensation, guaranteeing 14% growth taking FY16 as a base year.

Since then, for the next two years, GST was looking successful. But who knew! Economists. The economy started slowing down and GST revenues were affected. The governments were getting lower revenues and thus the center continued to compensate the hefty losses of states from the Compensation Cess Fund (CCF), the fund created to compensate states from the cess levied on sin and luxury goods.

|

| Scroll.in / GST vs. Old tax |

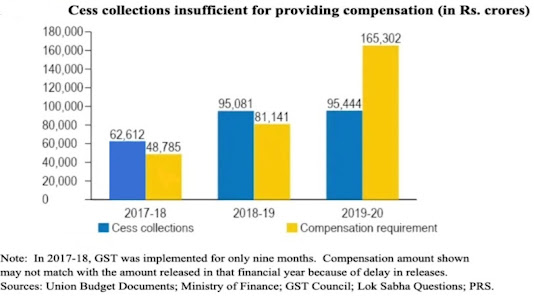

In FY20, the Center compensated INR 1.65 lakh crore to states from the CCF, in which there was only INR 95,444 crore left. The payments were over 70% higher than the collection. More than INR 64,000 crores of 2019-2020 compensation paid in 2020-2021 (FY21). The cess collection was only increased by 0.4%, while the compensation requirement surged by 104%. This was the first time the union accepted the economic slowdown and stated that the promised compensation would be affected. States raised concerns. Every time payments were delayed. The government then utilized money collected in the first two years of CCF and more from the Consolidated Fund of India. After this payout in March 2020, the Center did not pay for six months because of the lower revenues amid Covid-19 lockdowns.

The estimated GDP growth rate for FY21 was 10%, as predicted before the pandemic. Due to the Covid-19 pandemic and country-wide lockdown, the actual growth in FY21 was going to be much lower. Subsequently, the GST revenue would also be impacted. And the ability of the Center to pay compensation would depend on the cess collection. The pandemic has had deepened the economic slowdown and impacted revenues with GST collections recording a 41% decline between April and June 2020. The crisis was so bad that the union government at that time estimated that there would be INR 2.35 lakh crore of total shortfall in cess collection in FY21. It was also claimed that out of the total shortfall, only INR 97,000 crore can be attributed to CCF, while the rest is due to the unprecedented economic stress arising from the pandemic. The finance minister Nirmala Sitharaman stated that the pandemic situation was an 'act of God', indicating that the union government cannot help states anymore financially - a promise became a catastrophe.

|

|

India GST revenue growth to states, Estimated GDP growth as well as actual |

In between this, a report from the Comptroller Auditor General of India (CAG) found that the central government violated the law, during 2018-19, INR 90,000 crore was budgeted for states as compensation and collected INR 95,081 crore. But CAG reported that the government transferred only INR 54,275 crore to CCF and diverted the remaining amount to the Consolidated Fund of India (CFI), from which the government can use the money for whatever purpose. And the Ministry of Finance confessed the corruption. Adding money in CFI raises the government revenue and subsequently, the fiscal deficit artificially be lowered.

A report claimed that finances of over a dozen states continued to under severe strain, resulting in salary delays and sharp cuts in capital expenditure. States' reliance on GST compensation has increased over the times as GST accounts for roughly 42% of states' tax revenues, whereas tax revenues account for roughly 60% of states' total revenues. As the Center did not pay, the chaos started in July 2020 with state governments demanding their share of revenues. The Ministry of Finance, then stated that the central government would not be able to compensate furthermore as it has not have enough money in the CCF to payout. We can say that India is witnessing one of the biggest financial crises away from the reach of television media and the public, very few Indians knew about this, and even fewer knew it in detail amid fear of the pandemic and health crisis - seemed to be a closed-door financial crisis.

|

| Cess collection vs. Requirement to meet promised 14% |

Meanwhile, the opposition-ruled states were protesting publically as well as the government's own BJP-ruled states were protesting in closed doors saying the federal distrust would rise in the future if they would not be compensated. State governments then strongly suggested the central government should borrow money from the market and compensate them or the states would not be able to expend in between the pandemic. Some state governments also suggested hiking taxes and restructuring GST slabs. Legally, the central government is not liable to pay if there is not enough money in CFF, although it promised to compensate and it would be a moral obligation to do so. Also, the states have no legal power to increase further taxes and only the right to suggest to the GST council. In fact, one objective of introducing the GST was cooperative federalism, in which federal, state, and local governments interact cooperatively and collectively to solve problems. But there seemed to be no monetary responsibility of the Center for the Indian states.

In the GST Council meeting in October 2020, the Center suggested states should borrow money from the RBI - Full draft, giving them two options. The first option was at a fair interest rate for borrowing INR 97,000, the total shortfall. In this, the principal and interest amount can be repaid from cess collection (the compensation) even after 2022. The second option was to borrow the entire INR 2.35 lakh crore, the estimated shortfall. In this, states have to repay. But the issue was the union government can borrow with a much lower interest rate as compared to money lent to states and even manage easily. Even, there was one suggestion that the GST compensation has to be paid to states and compensation cess should be extended further from the year 2022 to meet the shortfall. But states were continuously pressurizing the Center to borrow money and claimed the full compensation as per a clause in the law. But the problem with the Center is if they were to borrow money, the overall government debt (public debt) would be raised. Currently, India's Debt-to-GDP ratio is 90% - source. If raised furthermore, it would affect India's image in the global market.

Until that time, the recession hit the Indian economy (GDP -23% in that quarter), while states and the center both were fighting for GST compensation. When the country needed authorities to work together for health infrastructure to deal with the coronavirus, they were arguing. At the same time, other countries across the globe were planning to get rid of Covid-19. Countries signed deals with vaccine manufacturers and upgraded their health infrastructure to fight the well-predicted second wave.

This was very serious as God's fault would be affecting the salary of government employees. If they don't get money, this subsequently affects consumption, weakens GDP. On the other hand, states were not to expend more, no efficient infrastructure, weakens GDP.

If we really focus and study some union business, some government entities such as the National Highways Authority of India (NHAI) and Food Corporation of India (FCI), whose debt is not calculated in the budget, but it is government debt as no banks would seize roads or highways, the fiscal deficit would shot up 5.8% (much more than estimated at that time), per a report by the government's auditor.

The bottom line is, the government did not have the legroom to borrow money as they were heavily indebted. States do not have the room to borrow money because they have been profligate spenders as well. States never thought of the Center being failed its obligations.

Finally, on the 15th October 2020, the Ministry of Finance decided to borrow INR 1.1 lakh crore. But it told states that that money would be borrowed to states. It means the states would have to bear all. The union government was just borrowing on behalf of states.

|

| GST Collection 2019-2021 |

After all this chaos amid the pandemic, Covid-19 cases saw a steady drop and the economy was recovering. The monthly GST collections were hitting all-time highs with over INR 1 lakh crore. Everything seemed to be on track. But who knew! Researchers - note, note. They warned the government on the second Covid-19 wave in November 2020. But they ignored between financial fight. And it hit hard India with a significant rise in daily cases and mortality. Rating agencies started downgrading India's GDP forecast. Economists started talking about the second chapter of the GST compensation fight. The second coronavirus wave started becoming a humanitarian crisis. The Center decentralized the vaccine approach and allowed states to procure vaccines. But states are already running out of money and need monetary support, as reported by BS that states need INR 30,000 crore to vaccinate 70% of a specific age group. According to Mr. Anshuman Tiwari, an economist, all decisions related to infrastructure are taken by federal authorities, although states are responsible for 70% of expenses. There are huge differences in pricing for the Center, states, and private players. Even if vaccination is decentralized, states' monetary power is fragile.

There are still questions that what will happen after 2022 when the Center will not be officially liable for compensating states. How Indian states will survive by spending less money than they used to spend? To what extent economic inequality will rise between states? How interstate relations will be impacted because of this? And never-ending questions...