{tocify} $title={Table of Contents}

Introduction

On 23rd March 2020, the Indian stock market saw its biggest fall as India locked down to stop the spread of coronavirus. Because of the hindered economic activities, businesses have suffered and so is the economy. People's lives have had suffered the most. Everything started recovering slowly as the pandemic-related restrictions were eased. The country was hit by the second wave of the virus as well. However, the Indian equity market outperformed in a matter of no time, doubling the investments. As well as, the primary market has seen many fresh companies receiving record funding. The companies have benefitted from the access liquidity available in the market. As a result, the valuations of these companies reached records highs, having an ideal time for some of these abnormally high-valued-low-profitability startups to enter the stock exchanges, offering the retail investors to invest, while providing the first investors an ideal exit.

The Equity Market

Sensex, the benchmark index which includes the top 30 Indian companies of the Bombay Stock Exchange (BSE), has gained 119.44 percent or 32,954.66 points since March 2020 low as of November 8, 2021. This year, on year to date basis, the index has gained 26.48 percent or 12,676.63 points. On the same hand, Nifty50, the index consisting of 50 top companies of the National Stock Exchange (NSE) has gained 123.52 percent or 9,984.75 points since March low, and 28.89 percent or 4,050.05 points this year so far, which is the highest in percentage terms in Emerging Markets (EMs). Check out our previous article India: The Best Performing Emerging Market.

This data is for the Indian equity market - the secondary market, that we all get to know in daily news reports. You wonder what happened to the primary market this year! Now, let us talk about the primary market.

The Primary Market

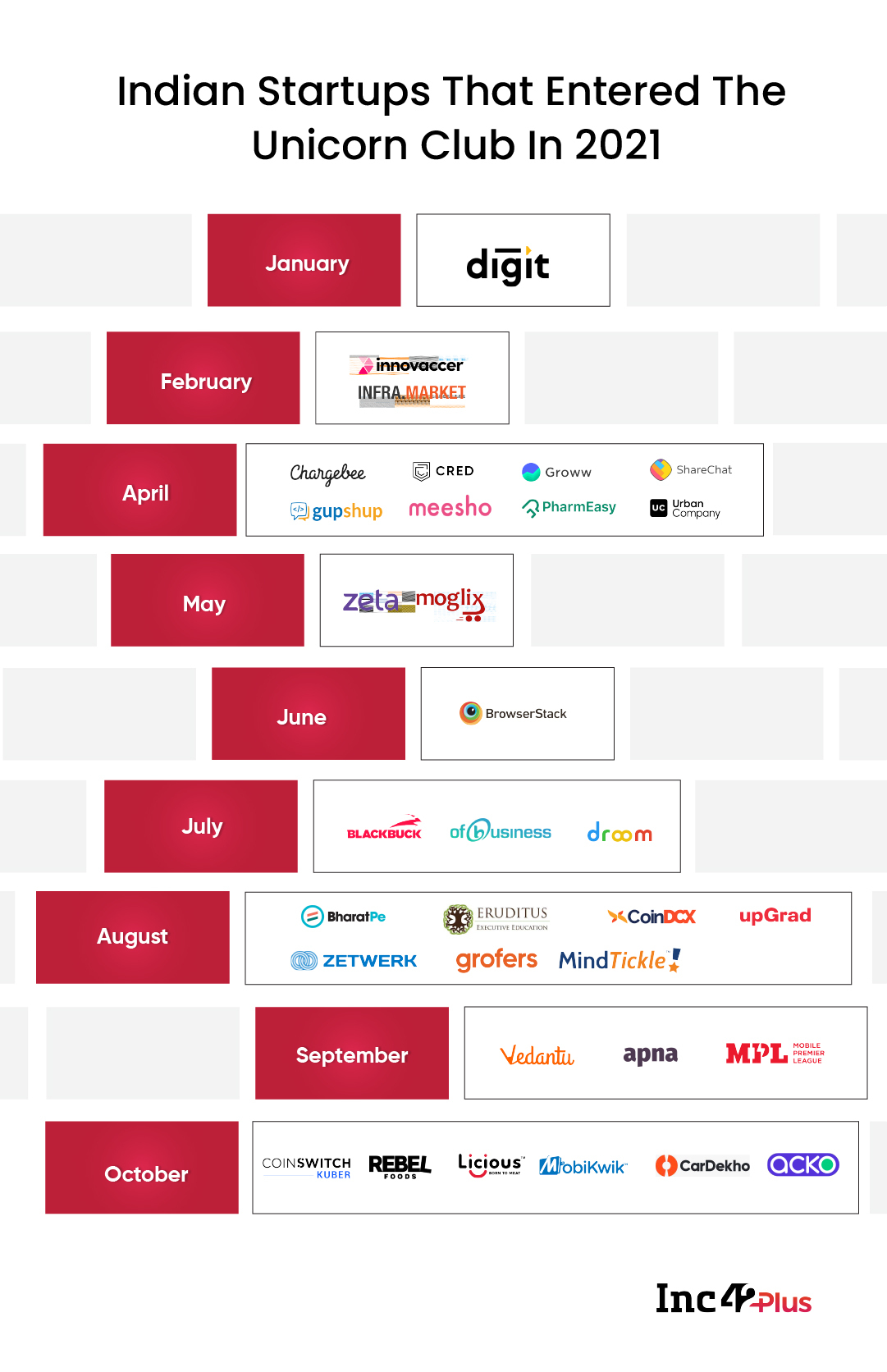

This year so far, according to Inc42, India has seen 33 startups becoming Unicorns, meaning a startup with more than $1 billion of valuation. All 33 startups are shown in the given infographic. The startups include many famous names such as Cred, Groww, ShareChat, GupShup, Meesho, PharmEasy, Urban Company, BharatPe, CoinDCX, upGrad, Grofers, Vedantu, MPL, CoinSwitch, MobiKwik, and CarDekho.

|

|

Image: Inc42 - All 33 startups that entered Unicron club in the first 10 months of 2021 |

Byju's: The biggest example

Byju's, the Indian Education Technology (EdTech) decacorn (a startup with more than $10 billion in valuation), picked up funding of ~$3 billion since last year, according to BusinessToday, and valued at $18 billion. Moreover, the edtech giant has acquired eight companies in 2021, including Aaksh Education worth $1 billion, totaling the acquisition spending worth $2.4 billion, per Inc42. Also, the Indian decacorn is said to value at a whopping $50 billion if it launches IPO in the coming months, according to some investment bankers.

The facts and figures of the post-pandemic IPOs

CARE Ratings, a credit rating agency based in India recently revealed in its report published on October 28, 2021, that during the calendar year 2021 so far, there have been IPOs worth ₹71,759 crores of 87 companies, as against ₹18,500 crores in the year 2020. There were 20 companies with more than ₹1000 crores of valuation that offered shares to the retail investors on the stock market.

With the dominance of the financial sector, ₹11,747 crores or 16.4 percent of the total money raised so far in 2021 are collected from issues by five companies, following the Auto and Ancillaries sector with ₹10,563 crores or 14.7 percent by four companies, according to Ace Equity. With Paytm IPO, the financial sector's amount would be totaled at ₹30,047 crores.

The dark side

Overall, around 56 percent percent of companies have provided higher returns than the issue prices, as of 26th October 2021. CARE Ratings further analyzed that the data and reported that there are 35 companies, which is 40 percent of companies that are trading below the issue price out of 87 firms. Furthermore, 20 firms have outperformed and doubled the money, which is only 23 percent.

Additionally, it does not mean that bigger companies means successful post IPO performance. There were 20 companies with above ₹1000 crores valuations, although only 12 of them are trading higher than the issue price.

Paytm: The one more

Paytm, the Indian fintech company launched the biggest IPO in India so far worth ₹18,300 crores. The fun fact is, out of this huge amount, the old investors disinvested ₹10,000 crores, which was Offer For Sale (OFS), and simply ₹8000 crores worth of shares were Fresh Issue.

The company, in its Draft Red Herring Prospectus (DHRP) filed to the Securities and Exchange Board of India (SEBI) mentioned that the company expects to continue to incur net losses in foreseeable future and it may not achieve and maintain profitability in the future. It added that if the company fails to maintain profitability, the financial condition would be adversely affected. It further added, the company cannot assure that it will ever achieve or sustain profitability on a consistent basis, which could cause the value of equity shares to decline.

Opportunity: Bullish Indeed, but expensive

Indeed, there is a huge potential these companies have, as I have written in my previous article titled The Investment Approach I Follow, when Zomato, the Indian food delivery startup launched its IPO. I talked about what should investors keep in mind while investing in loss-making unicorns on the stock market. Besides, I have written how technology companies' valuation gets significantly higher during their listing, giving examples of Google, Twitter, Zoom, and Facebook. With Paytm's IPO, it has become 70 times more valued than its operating revenue suggests, according to analysts.

The right time to invest in these companies is when they have an excellent value to pay. When they are providing you a profit. As Benjamin Graham once said, "Price is what you pay, value is what you get. Owning a business is more important than gambling given shares."

Opinion

Lastly, the purpose of publishing this article is to inform the amateur investors who started during the pandemic with millions of others and inform them as well as change the common perception of retail investors to 'IPOs can fail you as well.' Investors should stick with company fundamentals, and analyze before giving any penny in the name of investment. If old investors are exiting at a higher valuation, then why should you pay more!

And finally, as I always quote, "as a good business needs financial support for which investors step up, as investors' money deserves a fundamental study of business before going into the business, every fundamental study requires an investment of time for the money to be deserved and for the deserved business."