Listen to our Podcasts

Before getting into the actual story, we need to understand some basic things about cryptocurrencies in brief.

What Is Cryptocurrency?

It is a decentralized digital asset and a medium of exchange created to safeguard and increase the efficiency of digital transactions. All the transaction records are stored in the computer servers of cryptocurrency miners in the form of blocks and 16 digits encryption code. This code is mathematically secured; so, nobody except the owner of blocks allows the transfer. Cryptocurrency uses blockchain technology.

What is Bitcoin?

Bitcoin is the name of a cryptocurrency which have all functionalities as mentioned above. To simplify, Bitcoin is a network of independent computers that generate, deliver, and verify digital monetary transactions. Also, Bitcoin is referred to as BTC.

What Is Blockchain Technology?

Blockchain is a type of decentralized database that uses a peer-to-peer network to store the data in the form of blocks, created with a view to introducing a secure, enhanced, and efficient database. In a database, the blocks carry the hash of the previous block, creating a chain of blocks with every additional block strengthening the previous one. Hence, blockchain technology is resistant to change in the stored data because once recorded, the data in any given block cannot be changed without changing all subsequent blocks. Simply, the recorded data in the form of encrypted blocks cannot be changed without altering all the previous blocks. A hacker cannot change one block of information; if he/she does, all the previous blocks of information would be changed.

|

| This infographic by Blockgeek shows how blockchain technology is used by cryptocurrencies |

Cryptocurrency Mining

This video from the Wall Street Journal provides information on how Bitcoin and cryptocurrency miners work. As we mentioned below in this article that the Crypto mining is a lucrative business, maintaining the supercomputers that mine through mathematical calculation is a difficult process. While it is not environment friendly, Chinese miners predicted months ago that the government would ban cryptocurrencies at any time, affecting the biggest mining farm.

WSJ interviews the owner of Core Scientific, which is a US-based mining company. He said the company has raised $95 million in two years and installed mining facilities, including former denim and carpet factories. He added that the company's power infrastructure can handle the latest mining equipment, which consumes approximately 100 MWh electricity to mine one Bitcoin. To compare. that it the same amount of electricity used to watch television continuously for about 98 years. See the video for more details.

The Story Behind The Big Cryptocurrency Plunge In 2021

The total market cap of Bitcoin has had peaked in recent months and approached the range of some publically listed companies that are typically synonymous with monopoly. Bitcoin, after recording a high of $64,800, the world’s most popular and volatile cryptocurrency, plunged over 50% from its high in April to the low of $30,681 on May 19, 2021. However, the BTC bounced back to $37,000 on that day and to $41,000, while writing this article on May 20th, 2021. Internet Computer, which was launched last week, became the 8th largest cryptocurrency in the world, gaining $45 billion in just 2 days of launch, per Bloomberg. To compare, it is just below the net worth of the 5th richest person in Asia, Jack Ma.

It was not only Bitcoin, but the whole cryptocurrency market experienced a loss of $177 billion in market capitalization by the end of 19th May 2021. While cryptocurrencies saw the largest dip in a day, all of you may think about what factors really affected the biggest drop in a day. I have one name but it is not a factor after all - Elon the Musk.

But can he really disrupt the market? I would say yes and no at the same time. He can (he did), but not this much - a $177 billion loss in cryptocurrency market cap in a day. It equals the net worth of the richest person on earth right now, Jeff Bezos, per real-time Forbes, whereas more than the net worth of Elon, the second richest.

advertisement

The Three Factors Behind The Plunge

There are three factors that triggered the cryptocurrency market according to White Insights' analysis. These three factors changed the sentiments of market participants and lowered the trading volume as shown in the below chart. Also, the chart shows that there was a high-volume trend in months before the crash and after the crash when it increased significantly. First, it indicates that people dumped their Bitcoin holding and converted it to real-world currency. Secondly, it is noticeable that something influenced and raised the volume sharply.

|

| The image shows the price movement and net volume of Bitcoins transactions |

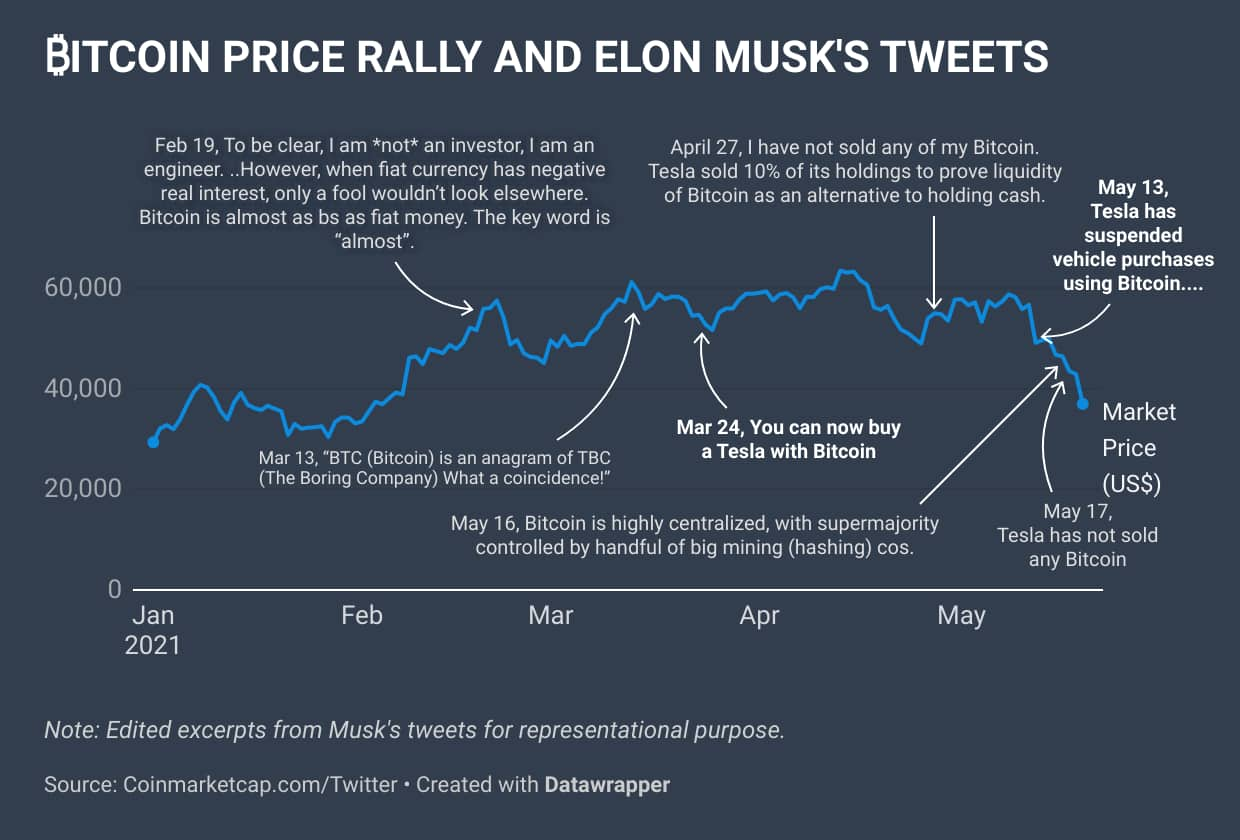

1. We have seen in the past that tweets from Tesla CEO Elon Musk influenced the cryptocurrency market, right? However, this time he didn't exactly influence, as shown in the below infographic.

|

|

|

Elon Musk-led Electric Vehicle maker Tesla was the first company to accept Bitcoin as a medium of exchange for its cars. However, Elon Musk announced on May 13th that Tesla will stop accepting Bitcoin, citing environmental concerns. Since then, the market fell dramatically, although the falling trend was started well before the announcement by the Tesla CEO. After the announcement, environmental concerns behind cryptocurrencies, especially for Bitcoin became a point of discussion. According to Nature, Bitcoin's growth could push the global temperatures by 2 degrees celsius.

Left: Elon Musk at 10:42

— Businessweek (@BW) May 19, 2021

Right: Bitcoin right afterhttps://t.co/wwMeToz2nx pic.twitter.com/BIGkirRXcf

The above Tweet shows that during the biggest fall in cryptos, Elon Musk tweeted "Tesla has." This immediately rallied the prices of Bitcoin and its net volume.

2. In the latest attempt by Chinese regulators, as reported by TOI, the nation banned the financial institutions and payment companies from providing services related to cryptocurrency transactions, while warning investors against speculative cryptocurrency trading. It stated that the crypto market has soared and contracted recently, as well as it quickly rebounded because of speculative trading, during the major power outage in China last month. It seriously violating on the safety of people's property and disrupting the normal economic and financial order, it added. The nation, after the warning, banned cryptocurrency exchanges and initial coin offerings but has not barred holders from holding.

advertisement

Here, we have to recognize that China is the biggest cryptocurrency mining farm - note. Moreover, one of the reasons to ban crypto can be environmental issues and to cope up with the Paris Climate Agreement, which China recently accepted officially. I have covered in my old article Posts By White Insights, the unknown facts about Bitcoins. Moreover, the hash rate and the power outage in China's Xinjiang, which triggered one of the biggest falls in Bitcoin price (18%) earlier in April 2021. The Hash rate of Bitcoin measures the total combined computational power that is being used to mine and process the cryptocurrency, dropped 45% because of a power outage.

As Elon Musk said earlier through his tweets, "it is highly centralized with supermajority control of a handful of mining (hashing) companies." China has a market share of around 45% in mining. These points raise concerns that is it really fair the call it decentralized! - note.

Furthermore, I explained why mining is a lucrative business but produces carbon dioxide more than Bangladesh in a year; and each Bitcoin transaction produces on an average 300kg of CO2, which is equivalent to 750,000 credit card swipes. As China is the biggest emitter of greenhouse gas emissions - see in this amazing infographic article, there could be one reason for the ban.

3. JPMorgan in a statement, during the market crash, said that big institutional investors dumping Bitcoin and preferring gold investments again, as reported by CNBC. It added that the institutional investors are reversing the trend that is performed during the last two quarters. After giving skyrocketing returns in recent months, cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin have had a free fall, losing around 30% of gains in just one week. As institutional investors are dumping cryptos, global gold prices surged to a three-month high of $1,890 per ounce on 19 May. Also, in reaction, there was a 19% decline in the Bloomberg Galaxy Crypto index on that day.

Overall, these three factors majorly changed the opinions of millions of crypto investors, causing the biggest contraction.

The Other Factors

Apart from these major factors, there are small causes that overall contributed to changing the sentiments of market participants. Our controversial currencies are fiat currencies. It means they are not regulated and backed by the government and regulators. So, they have an influence on how free markets operate. Cryptocurrencies were supposed to be free from any regulation, which was the basic objective of it, although that does not seem to be the case, as proved by the so-called Dogefather, Elon Musk. He did influence the market. There is no doubt. Also, in the past, he did the same with Tesla stock prices. The manipulation, while influencing people to speculate. Even Dogecoin creator Jackson Palmer referred, Elon to as a 'self-absorbed grifter' for the hoax that he created. In many countries, there are rules that hinder a person from influencing the money market single-handedly. But in this, there would be no evidence. Consider Elon as a trigger of a gun, while, there are many more influencers, who influence the prices of cryptocurrencies regularly using social media platforms such as Twitter, Reddit and become news.

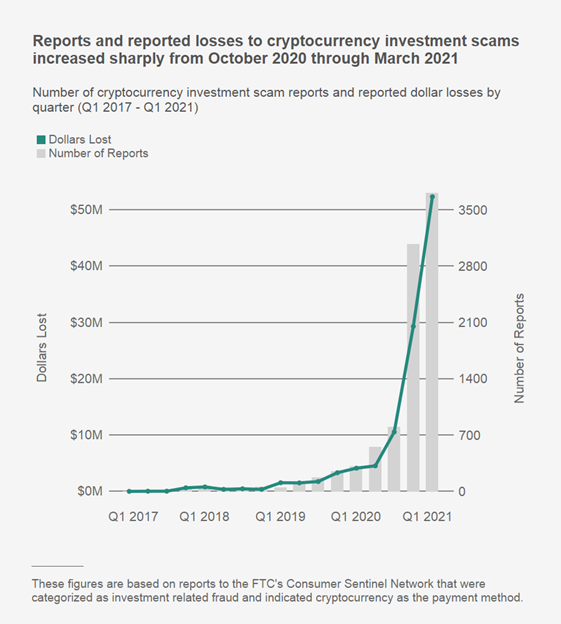

Recently, IBT reported that the fake identity of Elon Musk, an impostor cost cryptocurrency investors over $2 million in the span of six months alone. As stated in the US Federal Trade Commission data on cryptocurrency scams, the below chart shows the increased number of reported scams and the lost amount.

|

| The infographic shows the rising number of reported scams and the amount of money lost - image source |

Around 7,000 individuals reported falling victim to scams. The regulator reported over $80 million lost, with the average loss sitting at $1,900. The regulator said the new cryptocurrencies are particularly prone to fraud, especially for those unfamiliar with the rapidly developing cryptocurrency landscape.

advertisement